nj property tax relief check

Property Tax Relief Forms. We will mail checks to qualified applicants as.

Anchor Tax Relief For Homeowners Renters Nj Spotlight News

To put this in perspective the.

. Residents who paid less than 500 in income tax will receive an amount equal to what they paid. Covid19njgov Call NJPIES Call Center for medical information related to COVID. Property Tax Relief Programs.

About two million New Jersey homeowners and renters will get property tax rebates in the coming year under a new 2 billion property tax relief program included in the. The New Jersey Homestead Benefit Program provides property tax relief to eligible homeowners in the form of. The filing deadline for the 2018 Homestead Benefit was November 30 2021.

If you were in the program prior to the move and received a reimbursement for the last full tax year you occupied your previous home you may qualify for the 2-year exception. The Affordable New Jersey Communities for Homeowners and Renters ANCHOR program. The property tax relief was only at levels it was supposed to be for one year-- in 2007.

COVID-19 is still active. For example if an eligible family paid 250 in taxes they would get a 250. Check the Status of your Homestead Benefit.

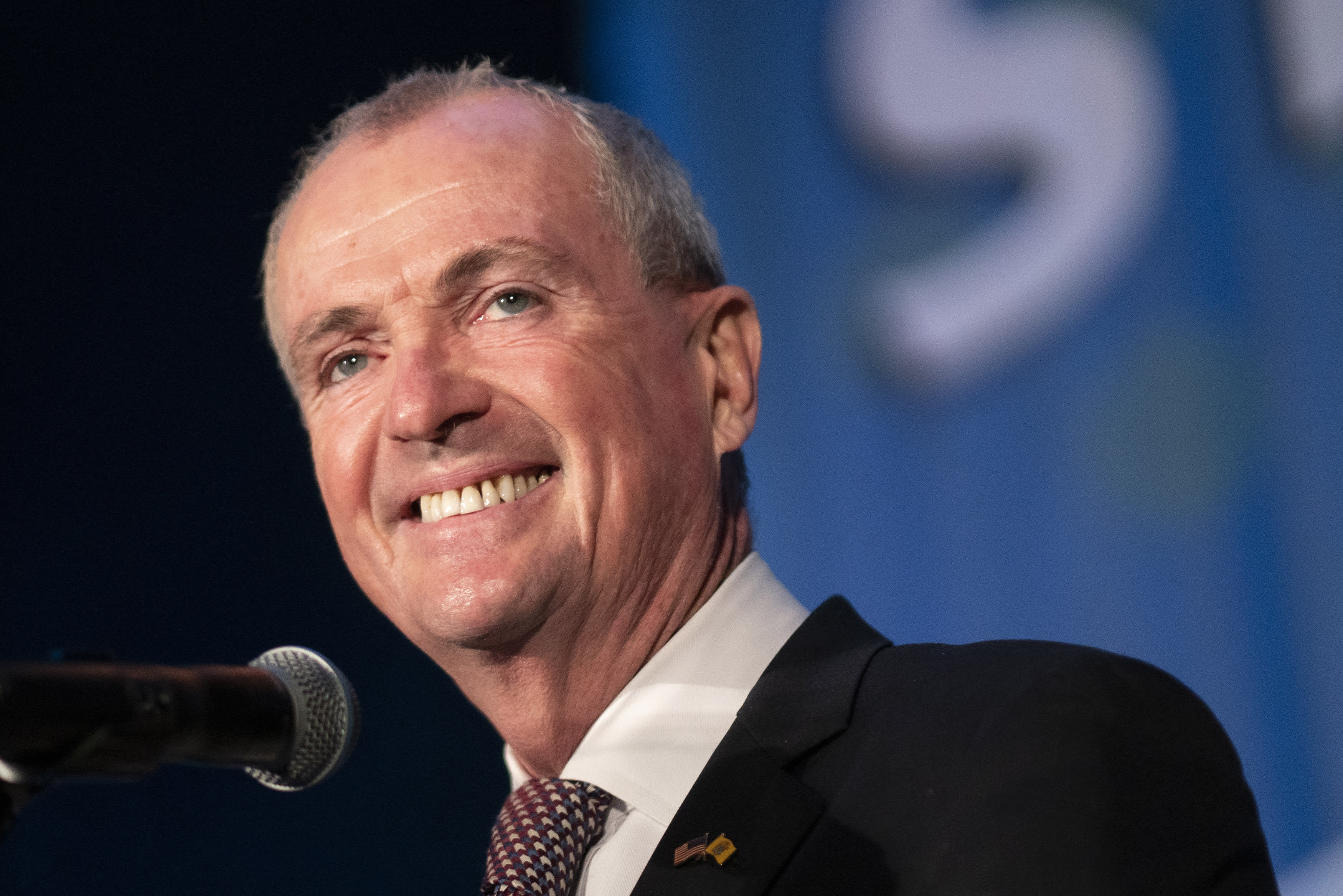

The average 2019 property tax bill in New Jersey is 9000. Our Newark Regional Information Center at 124 Halsey Street will be closed Thursday October 13 and Friday October 14 2022. Phil Murphy has unveiled a property tax relief plan for nearly 18 million state residents for fiscal year 2023.

If a reimbursement has been issued the system will tell you the amount of the reimbursement and. Applications for the homeowner benefit are not available on this site for printing. Unlike Hawaii Alabama and Colorado which are states with the lowest property taxes New Jersey has one of the highest tax rates in the country219.

We have begun mailing 2021 Senior Freeze Property Tax Reimbursement checks to applicants who filed before May 1 2022. Use our Check Your Refund Status tool or call 1-800-323-4400 or 609-826-4400. NJ property tax relief to expand.

Check the status of your New Jersey Senior Freeze Property Tax Reimbursement. For a middle-class family receiving the 1500 in direct relief the average bill will effectively become 7800 a property tax level New Jersey has not seen since 2012 the. Enough already said Murphy at the time.

Over the last decade the average New Jersey property-tax bill has increased by more than 1500 before adjusting for inflation to a record-high total of 9284 last year. Homeowners making up to 250000. Stay up to date on vaccine information.

Check the Status of your Homestead Benefit 2018.

Nj Property Taxes Have Been Rising At A Slower Pace Nj Spotlight News

N J S New Anchor Property Tax Program Your Questions Answered Nj Com

Nj Division Of Taxation Anchor Program

Will You Get A Break On Your Nj Property Taxes

Tax Assessor Township Of Franklin Nj

Department Of The Treasury Anchor Affordable Nj Communities For Home Owners Renters

Nj Property Tax Freeze Do I Qualify For Senior Freeze Program

Property Tax Reimbursement Inquiry Nj Taxation

Tax Collector S Office Manville Borough Nj Official Website

N J Senior Freeze Property Tax Relief Checks Could Soon Become Tax Credits Nj Com

Stimulus Update 2022 These States Are Proposing Payments To Residents This Year Nj Com

Nj Property Tax Relief Program Updates Access Wealth

Murphy Proposes New Direct Property Tax Relief Program New Jersey Monitor

Nj Division Of Taxation Senior Freeze Property Tax Reimbursement Program 2017 Eligibility Requirements

Gov Murphy Unveils Anchor Property Tax Relief Program Whyy

New Jersey Governor Floats Property Tax Relief For Homeowners Renters